Questions To Ask Yourself In Order To Prepare For The Coming Currency Collapse

Dollar degradation and what you should do about it?

Q. Are you comfortable holding your money in the bank considering the bail-in laws and the inadequate funding of the FDIC?

A. When you put money in a bank, you trust that institution to keep your deposits secure. However, in a post Dodd-Frank world you are not simply a customer or depositor – you are actually legally classified as an “unsecured creditor.”

Q. Are you concerned about the exorbitant debt levels our country is taking on? And the record debts of the American people?

A. The US Debt Clock brings things into focus. US Debt Clock

Q. Do you know the difference between money and fiat currency? Which do you think is preferable for you to hold?

A. Fiat currency is unbacked currency issued by a central authority like a government or a bank. Money is a store of value over time like gold or silver. And I would argue Bitcoin.

This excellent docuseries explains the truth about money, fiat currencies, and how currencies end. The Hidden Secrets of Money Mike Maloney argues we are going to be witnessing the greatest wealth transfer in history along with this currency collapse.

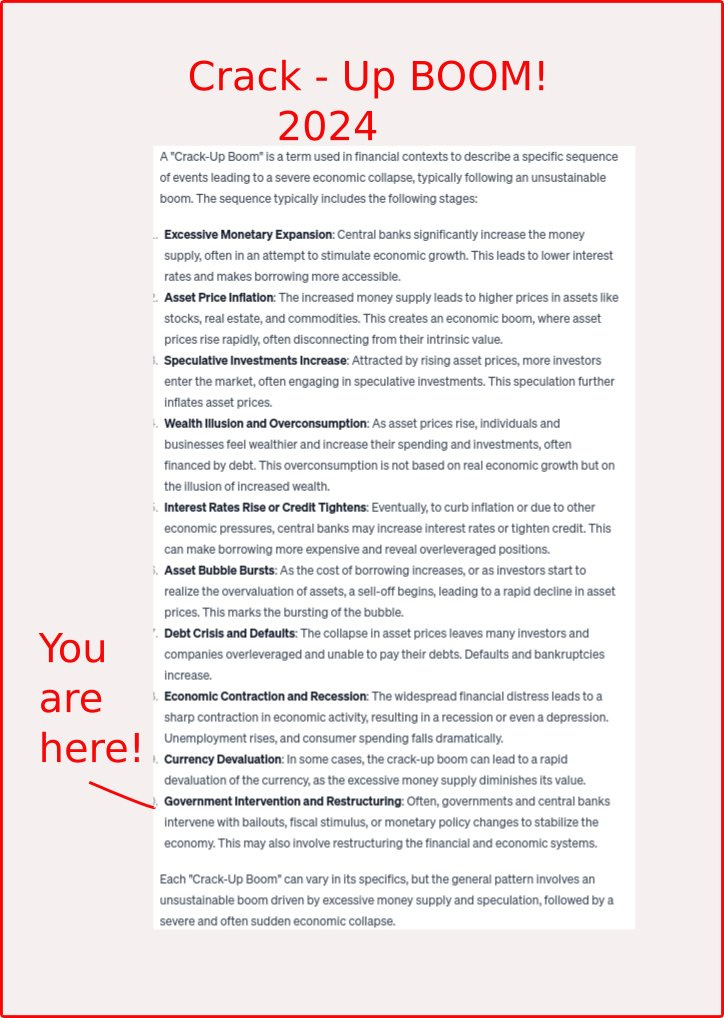

Ludwig Von Mises, Austrian economist, describes what he called the crack-up boom. When people expect, that in the future, the money-supply growth rate will increase to ever-higher rates, the demand for currency would, sooner or later, collapse. Such an expectation would lead (relatively quickly) to a point at which no one would be willing to hold any currency — as people would expect currency to lose its purchasing power altogether. People would then start fleeing out of currency entirely. The greatest historical example of this occurred during the Weimar Republic in Germany in the 1920s.

Borrowed from Clif High’s X feed: Steps to the Crack-Up Boom.

Q. What is decentralized finance, “DeFi,” or peer to peer capital markets?

A. Reggie Middleton invented peer to peer capital markets with his patented technology called Veritaseum. No centralized authority to “manage” our money or to play the middleman taking fees for transactions. Reggie founded DeFi in 2013, patents issued: JP6813477B2, US11196566, US11895246B2, JP7204231b2.

Q. Are you aware of the plan to introduce central bank digital currency CBDC? Emphasis is on "central." Anything central is not yours. Let that sink in.

A. As the economic situation becomes ever more desperate and inflation spirals out of control, the central banks, partnering with governments, will attempt to issue central bank digital currency, removing paper currencies from circulation. At that time any privacy you had with paper currency will evaporate. All transactions will route trough the central system and all your purchases and trades will be fully known by the central authority. I call this central bank digital slavery.

A new international monetary system was forged by delegates from forty-four nations in Bretton Woods, New Hampshire, in July 1944. Delegates to the conference agreed to establish the International Monetary Fund and what became the World Bank Group. The system of currency convertibility that emerged from Bretton Woods lasted until 1971, when President Nixon took us off the “gold standard.”

What replaced Bretton Woods has come to be known as the petrodollar, whereby any country wanting to purchase oil had to first convert local currency into US dollars. Since every economy needs oil to fuel it, the arrangement raised the status of the US dollar to that of the world reserve currency.

The US defended its world reserve currency status by employing the military to ward off threats to the dollar. For example, when Iraq began to accept Euros in exchange for oil, the US invaded Iraq on the premise that Saddam Hussein harbored “weapons of mass destruction.” He was found not to have them, but he was hanged, and Iraq was forcibly put back on the petrodollar standard.

Colonel Qaddafi sought to introduce a gold backed dinar into Africa, circumventing the petrodollar. As a result, Libya was invaded, Qaddafi murdered, and Libya’s gold was confiscated. Iraq and Libya were unable to defend themselves from the might of the US empire.

Fast forward to today. The current challenge to the US dollar is coming from the BRICS+ nations. They have seen what happens to countries who don’t go along with dictates coming from the US empire. Sanctions are deployed, and we see for example that Russia has had its dollars frozen by the SWIFT system. The talk now is about confiscating the frozen dollars that belong to Russia. Naturally the rest of the world is paying attention.

It should be obvious to everyone that US hegemony, and control of the world reserve currency is on the wane. No nation wants its policies dictated to it under threat of sanctions or currency confiscation. No doubt that is why nations are applying for admission into the BRICS+ intergovernmental organization. An organization whose members can trade with each other outside of the US dollar. 3.3 billion people live in BRICS+ nations, making it unlikely that a war with the BRICS+, or even with Russia and China alone is likely to force everyone back on the US dollar. So a military solution is unlikely to work, but that doesn’t mean it won’t be tried. As Gerald Celente contends, “when all else fails they take you to war.”

In my view, here in the West we can expect governments to try to force us into a central bank digital currency. If we accept it, and we do have a choice, we will in effect be accepting central bank digital slavery. Of course the powers that be will make it easy for the uninformed to willingly accept it. It will be promoted by the media as the greatest thing ever. They won’t mention you will be giving up your freedom. That realization will come later. Some won’t care as long as they can buy food and other necessities.

Biological and physiological needs are at the bottom of Maslow’s hierarchy of needs. If those aren’t met, the rest don’t matter. “Newcomer’s” dreams of freedom may in fact be met as their measurement bar for freedom could be low, depending on where they came from. Many are taking the hand-outs from the current administration, so their new-found “freedom” probably feels pretty good.

And now a Federal Judge, Sharon Johnson Coleman, has ruled that “newcomers” can carry guns. This at the same time that some jurisdictions want to confiscate guns owned by US citizens. To whom does the 2nd Amendment apply? I’m confused.

So the question becomes, will we accept the centralized authorities replacement for the US dollar, or will we choose money that we can own ourselves? The choice amounts to choosing between slavery or freedom. Choosing freedom is difficult and amounts to a second American revolution, where we throw off the yoke of our monetary oppressors. We choose freedom by rejecting the introduction of central bank digital currency. Instead we opt for using money that’s in our control; like gold, silver, and crypto currencies such as Bitcoin, Litecoin and DigiByte. We operate with Reggie Middleton’s patented peer to peer technology using Veritaseum and smart contracts. This is our path to freedom if we are wise enough and bold enough to choose it.

Since we have a choice, shame on us if we choose slavery over freedom.

https://rubino.substack.com/p/elites-commoners-and-the-shrinking/comment/52368819?utm_source=share&utm_medium=android&r=4qa41

The fight to roll in CBDCs involves Mastercard and Visa. Capitol One in an effort to purchase Discover.

They want your digital ID...

https://rumble.com/v4ktoc3-dig-it-215-urgent-alert-state-legislatures.html